Leverage Big data for fraud detection

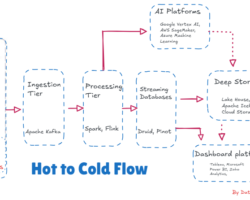

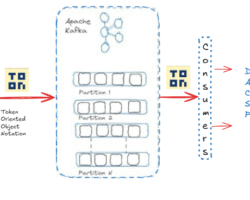

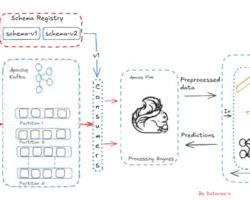

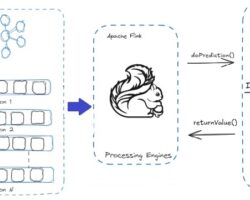

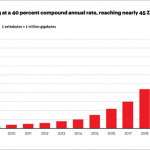

Just writing few lines regarding leveraging Big Data for fraud detection. Now a day’s Financial industry as well as Banking system are facing most costly challenges in terms of fraud and other financial crimes. Big Data processing framework like Hadoop and its eco systems are started helping to detect, prevent and eliminate internal and external fraud as well as reduce the associated costs.

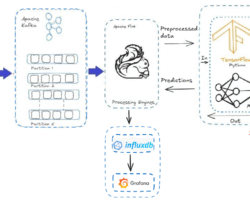

Analyzing points of sales (POS) in shopping malls. hospitals, retail stores etc and other transactions places, Banking system are capable enough to identify and mitigate fraud immediately.

Effective usage of Big Data processing and analytics, can alert the bank that a credit or debit card has been lost or stolen by picking up on unusual behavior patterns. This then gives the bank time to put a temporary hold on the card while contacting its account owner. This helps Banking system to prevent or stop the further payment transaction carried out by criminals till customers initiate actions from their end.

Written by

Gautam Goswami ![]()

Can be reached for real-time POC development and hands-on technical training at [email protected]. Besides, to design, develop just as help in any Hadoop/Big Data handling related task. Gautam is a advisor and furthermore an Educator as well. Before that, he filled in as Sr. Technical Architect in different technologies and business space across numerous nations.

He is energetic about sharing information through blogs, preparing workshops on different Big Data related innovations, systems and related technologies.